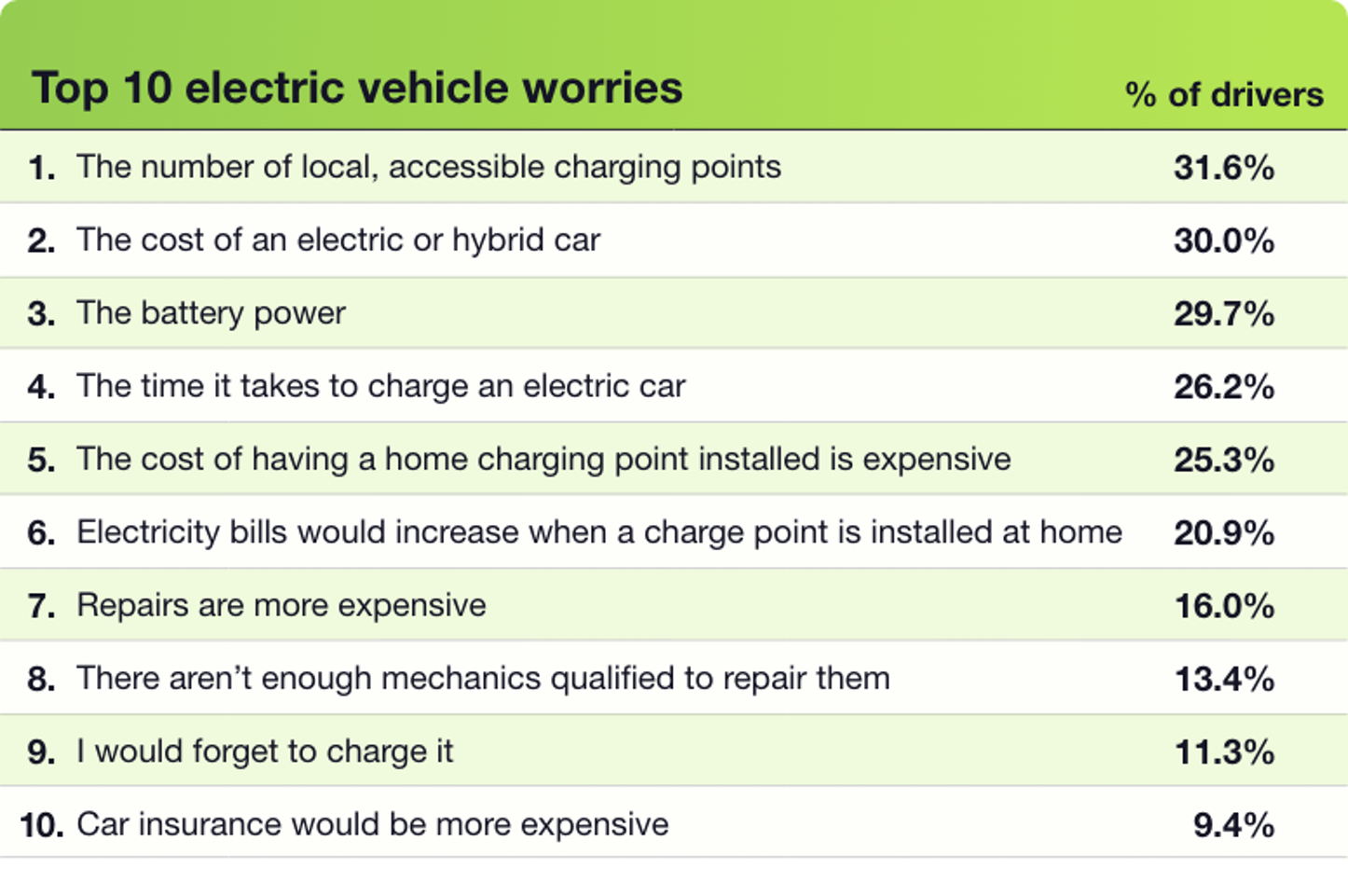

Thousands of drivers across the UK are concerned about how electric vehicles will impact the cost of car insurance, with over 80,120 Google searches on the subject, and 13,480 in October 2020 alone.

Questions like “How much does it cost to insure a Tesla?” and “why is car insurance expensive for EVs?” were amongst some of the other most popular questions, receiving over 2,000 searches in the last month.

Alongside this, a recent study from Uswitch revealed that one in 10 drivers think electric car premiums are too expensive, with one in eight of those aged 17-24 admitting this would potentially stop them making a purchase.

Read next: Top five things to consider when buying a new car

Uswitch car insurance expert, Ben Smithson, said: “While some electric vehicles are more expensive to insure due to the cars’ higher purchase price, the need for specialist equipment and repairs, and a lack of data on driver behaviour, as more drivers make the switch to electric, it is predicted that the insurance market will undergo a degree of correction. As a result, premiums will eventually fall, making EVs and Hybrids more accessible to a range of drivers.”

To help drivers find the best option for them, we answered some of the most asked questions on insuring an electric car.

Will my car insurance be higher if I purchase a hybrid or electric car?

A lot of new electric and hybrid vehicles come with high price tags, so if you’re thinking about buying an eco-friendly car, it’s a good idea to get some quotes beforehand, as you could be faced with a higher insurance premium.

When considering the insurance group of your vehicle, insurers also assess ease of finding a professional qualified to repair the model and the cost and availability of parts.

Buy a car phone mount on Amazon (Affiliate)

Currently, just 1 in 20 mechanics are qualified to repair and service electric vehicles, this number is set to rise, with automotive employers quickly adapting to the demand.

Alongside this, insurance providers consider whether there’s an increased risk of an accident. This considers the ways in which driving an electric or hybrid car can feel different than driving a petrol or diesel car. For example, most electric vehicles have silent acceleration, which could be dangerous if other road users are distracted.

Read next: Vauxhall Corsa-e review: An electrified classic

Do I need specialist insurance if I purchase an electric vehicle?

While you do have the option to take out a dedicated electric vehicle insurance policy, as sales rise, many mainstream providers are starting to offer EV and hybrid policies, making it easier to find the best cover.

To help drivers manage the cost of an electric car, manufacturers such as Renault and Nissan provide the option to buy the vehicle and lease its battery separately.

If you lease the battery, your provider may offer separate insurance in case of accidental damage or theft. You can also get insurance for portable charging cables, which will cover you if your cables are lost, damaged or stolen when stored in your car or in use at a designated charging location. Finally, there’s a legal liability which will cover you if someone accidentally trips over your charging cable during charging.

Read next: Peugeot e-2008 review: A masterfully designed electric SUV

How can I save money on my electric vehicle insurance?

There are a number of things you can do to help lower the cost of your premiums, regardless of whether your car is petrol or diesel, electric or hybrid. These include:

- Reducing your miles: the less you use the car, the lower the risk of being in an accident.

- Adding a named driver: if you’re under the age of 25 or have previous driving convictions, adding an experienced named driver to your policy could help lower the cost.

- Pay up front: if you can afford to pay the annual cost upfront, you could save 20% or more, depending on your provider.

- Increase your excess: if you’re willing to pay more in excess, providers are more likely to reduce your premium.

- Don’t auto-renew: make sure you’re shopping around for the best deal before renewing your car insurance policy