Electric vehicles are growing in popularity. The increase in both the demand and supply of cars, trucks and bikes has created a new wave of customers and manufacturers entering the market. As a result, there are now more electric vehicles (EVs) on our roads today than there has ever been; with it comes a push to expand the EV network – from government incentives to companies such as EVBox ploughing energy into countries’ charging infrastructure.

To better understand the transitional shift toward a greener future and to grasp what challenges companies are faced with, TotallyEV interviewed Jonathan Goose, Regional Director of UK & Ireland at EVBox, for comment.

Read next: Kia e-Niro review: The best all-electric SUV?

What are the biggest stumbling blocks for consumers transitioning toward EVs?

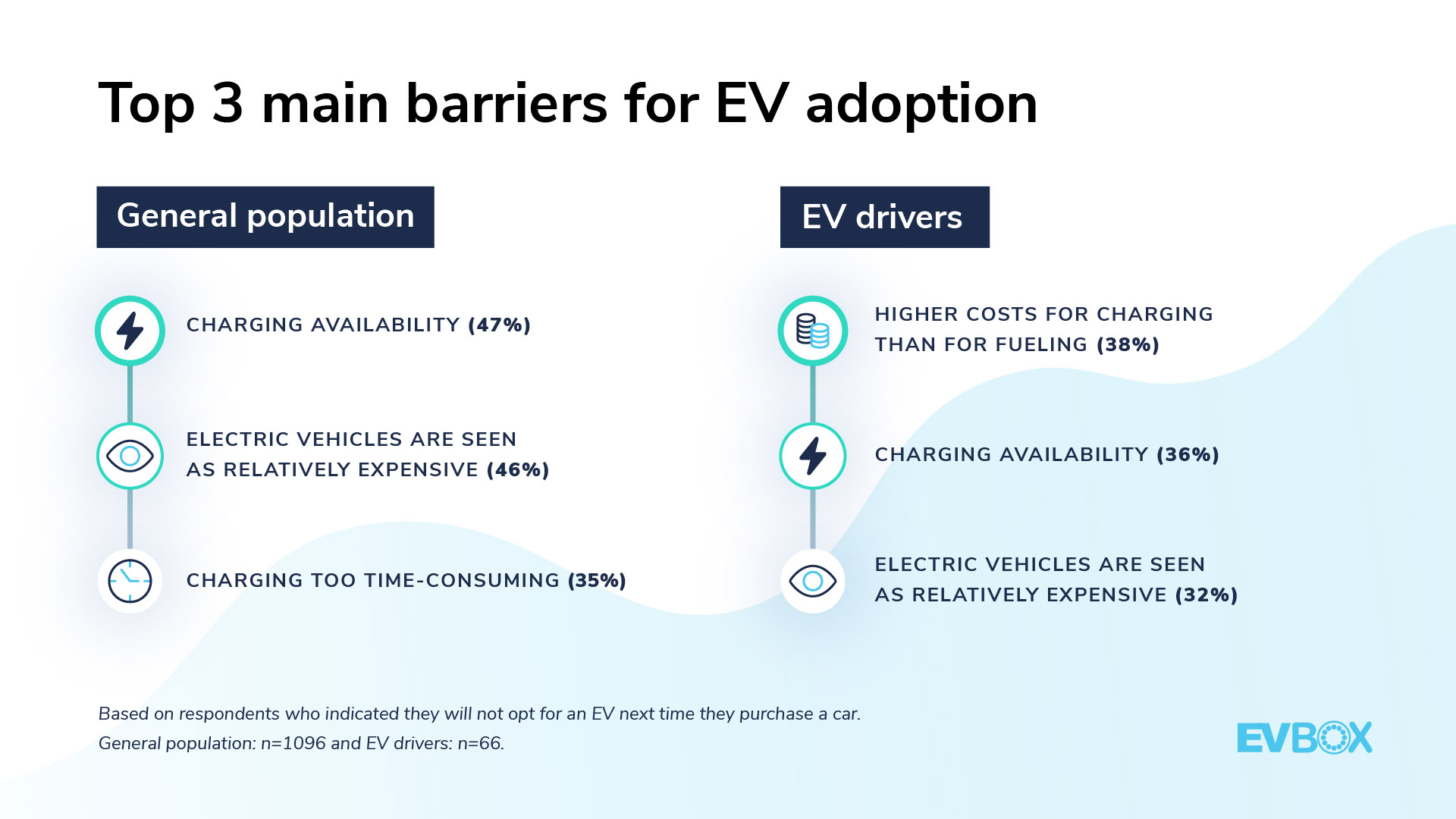

The top three main obstacles we’re seeing for consumers in the UK transitioning towards EVs are the availability of charging points, the perceived high price of EVs, and charging being too time-consuming.

Another big challenge is the lack of affordable second hand EVs due to the market immaturity, so although there is positive sentiment around wanting to combat climate change, consumers are finding it difficult to take the next step.

Buy a car phone mount on Amazon (Affiliate)

Are companies faced with even tougher tasks of providing charging points to their workforce?

Yes, primarily because of the cost of installation and power capacity. Additionally, the current COVID-19 pandemic is impacting how willing companies are to invest at this moment. However, the UK government provides subsidies of up to 20 chargers for workplaces through the OLEV grant. In addition, knowing that a strong number of the general population is keen on addressing climate change in transportation, it will encourage businesses to provide charging points to their workforce, especially if the government’s goal is to be all-electric by 2035 (and likely to be brought forward to 2030). Similarly, some charging stations have dynamic load balancing features with adjustable charging power that address concerns of power capacity at a workplace.

Read next: Government car grant for electric cars: A complete guide on the PICG

How has the demand changed for charging points over the last 5 years?

Demand has changed from dumb chargers with 3,7kW 16A slow charging, to smart communication devices with MID meters, UMTS or Wi-Fi communication at 7.4kW 32A with an ability to auto reimburse costs from employers.

Our EVBox Mobility Monitor report shows that the general population, including potential EV drivers, are eager to address climate change through reducing CO2 emissions in transportation with electric vehicles. On the other hand, the EV industry is expected to grow exponentially year-over-year.

As of September 2020, electric vehicles encompass nearly 7% of car market sales in the UK (which equates to 21,903 pure-EVs), up by 184% from the previous year (7,704 pure-EVs). With more electric vehicles expected to be on the road, the demand for charging points is expected to grow to address the issue of accessibility and driving range. In 2015, there were only around 10,000 public charging points in the UK, whereas today, there are almost 35,000 public charging points, showing a growth of nearly 250%!

Read next: What is an EV? Everything you need to know about hybrid and electric vehicles

We are also anticipating that customer-centric features, such as touchscreens, charging indicators, along with future-proofing designs such as upgradable power capacity and wearproof features, will attract more potential EV drivers and increase demand for more charging points. Lastly, the UK government’s goal of becoming all-electric by 2035, or possibly 2030, will drive businesses and consumers to act quickly.

Has COVID-19 impacted the number of EV charging points being installed across the UK?

The pandemic has certainly slowed down the installation of charging points across the UK, as almost every business and sector has had to pause and face new challenges this year. The market was initially impacted in Spring during the first unexpected lockdown, meaning no installations were made at all.

We have seen a big impact in consumer purchasing behaviours due to the uncertainty surrounding the pandemic, commercial vehicle usage plummeting due to shut down of non-essential services and supply chain disruption as global trade has slowed down. However, as we navigate a safe way out of the pandemic crisis, we expect the market to grow by 30% to match the increase in EVs sold.

Do government incentives impact purchasing decisions, be it residential or commercial consumers?

Yes, as noted in our report, future EV drivers are looking to their governments when it comes to incentives for switching to an EV. Particularly in the UK, we have specific incentives such as the Office for Low Emission Vehicles grant (OLEV) and the UK charging infrastructure fund to help consumers and businesses purchase chargers. These grant subsidies can reduce the cost by £350 on a home install and up to £14,000 on a commercial installation.

Read next: MG ZS EV review: An affordable all-electric SUV

Is the UK government doing enough for consumers to feel comfortable in transitioning to an all-electric future? Is the 2030/2035 goal realistic?

The UK government is investing millions of pounds in developing a comprehensive charging infrastructure, and providing incentives for purchasing a charging station and an electric vehicle or plug-in hybrid. As seen in the results of our annual EVBox Mobility Monitor, the majority of the population believes that addressing CO2 emissions in transportation is crucial to combating climate change. However, more needs to be addressed by governments and businesses around these challenges. Looking at the low supply of affordable electric vehicles and lack of charging availability, we still have a long way to go.

Have you seen an increase in demand from property managers, namely for a block of flats? If so, what are the biggest challenges and were they overcome?

The demand in this market is yet to be seen as it is still in its infancy and is currently underdeveloped. The UK is waiting for new regulations from the government around the guidelines and the number of chargers required for apartment blocks. Once the government has addressed this market, we are expecting to see an increase in demand.

Buy a car phone mount on Amazon (Affiliate)

Across the UK, which borough has seen the most demand/willingness to install new chargers?

Some regions in the UK are more advanced than others. According to Zap-Map, the highest distribution of charging points are in Greater London (8961 charging points) and South East (4788 charging points), which can correspond to an increase in demand due to a higher population. However, because of the government’s goal to electrify transportation by 2035 (possibly 2030), it is expected that all regions will have a high demand to install new chargers over the next decade. For example, in West Yorkshire, they are building a 100 DC rapid charging network for taxis that is almost complete.

Read next: Paving the way to net-zero with EV adoption

Public DC fast chargers are harder to find over 3-7kW charge points – why is this the case?

This is mainly due to the cost of installation along with the current number of EVs on the road. Also, they are predominantly used for public charging on main highways and therefore not visible in cities. Nevertheless, seeing the exponential demand of consumers to switch to alternative and sustainable transport, as well as EVs in all price ranges entering the market each year, the demand for fast charging will certainly increase as well.

Another challenge for DC fast charger installation is the location of where they should be placed, as we often find that the grid connection is not feasible or too expensive in a certain spot. A lot of the time, grid connection regulations make it difficult to deploy a fast-charging network, since they do not only vary between countries but sometimes even within a country in different regions. Also, getting a building or installation permit can take quite some time. An early stakeholder involvement from the beginning of a project for fast charging station installation can prevent a lot of those challenges in the first place.

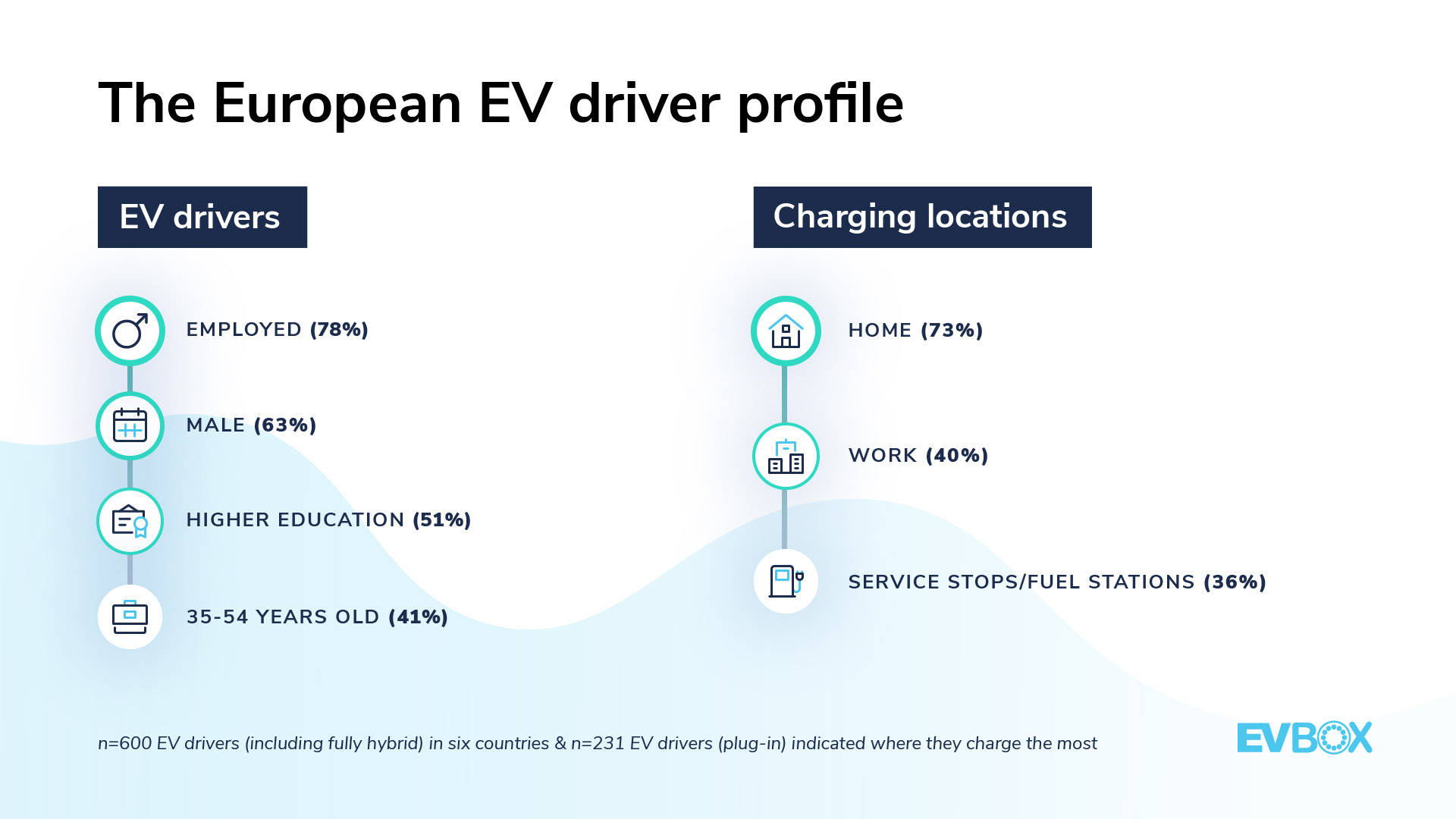

We expect around 2,500 installations of DC chargers in 2020. Networks such as Geniepoint are currently being built, so we are likely to see more of them. Also, 3-7kW chargers predominantly for home and workplace use, so there are several hundred thousand of them installed. In fact, 75% of charging is carried out at home and at work.

EVBox is ready to meet those demands. In our newly renovated facility, we’re able to ship 5000 DC charging units per year produced to the very highest quality.

Read next: Volkswagen e-up! review: A bite-sized electric car

Does an increase in faster chargers have a negative impact on the environment? Are all chargers using renewable sources, and is there a way of checking what companies claim?

This highly depends on the party that installs those fast chargers. For example, some power plants use non-renewable to power an electrical grid, whereas some chargers can also be powered by renewable energy through the absorption of wind and solar energy. However, the zero-emissions of EVs counteracts combustible engine vehicles by decreasing the overall CO2 emissions.

Faster charging is good for power grids, contrary to current beliefs. According to Fastned, fast-charging stations on medium voltage grids have unique properties that can play a role in stabilising the grid & absorb large amounts of renewable energy (solar and wind).

If DC is the primary mode of charging for EVs, then it can decrease the power capacity of the car battery faster than AC charging. Consequently, the batteries will need to be replaced at a faster rate. However, this is not the case because many drivers charge at home or at work (which primarily uses AC). In addition, car batteries are recycled and reused for other purposes such as powering street lamps.

You can also argue that the more electric charging that is carried out, the less petrol/diesel that is being burnt. There are many charging operators, such as Engie, that are only providing power from a sustainable source such as solar and wind power.

Read next: Can hybrid cars be recycled?

Why do charging installers/providers all have their own payment method – why hasn’t this been unified?

Firstly, I must point out that there are a number of different payment structures currently operating. The complexity of price transparency lies in the fact that there are multiple parties with various acronyms (CSOs, CPOs, eMSP and CDR) involved when calculating the final price of a charging session:

- Charging Station Owner: this is the owner of both the charging stations and the location that they are installed at. Often, though not exclusively, this is a business that has decided to provide EV charging at their private location. Depending on the location and type of owner (semi-public, public, private) the energy is purchased by either the charging station owner or the charge point operator. CSOs are also responsible for setting the initial pricing tariff.

- Charge Point Operator: this is an entity, like us, that’s responsible for the management, maintenance, and operation of the charging stations (both technical and administrative).

- eMSP stands for eMobility Service Provider: this is an entity that the EV driver has a subscription for all services related to the EV operations. We also act as an eMSP and provide EV drivers with access to charging stations.

- Charging Detail Record: this is the charging transaction information (including the tariff set by the CSO) that is sent from the CPO to the eMSP after every charging session.

The market is still maturing, and the current status shows that some chargepoint operators have their own networks and are making offers to their customers. At the moment there are currently two payment options: paying with an RFID card or by direct payment. Which kind of RFID card EV drivers can use depends on the MSP contracts that CPOs have for their stations.

However, contactless payments will become normal in the new public chargers due to new regulations and they will soon allow payment as you go. Most recently, here at EVBox, we have introduced our new charging management app, EVBox Charge, which enables EV drivers to pay with their credit card at charging stations managed by EVBox.

Buy a car phone mount on Amazon (Affiliate)

In order to unify the EV charging methods, providers must look to joining roaming schemes. EVBox, for example, joined the EV Roaming Foundation in order to facilitate the best possible driving and charging experience for all current and future EV drivers. It is important that all parties in the eMobility market are working toward the complete transparency of information across borders, and this foundation is working towards this goal.